HDFC Bank : Check Credit Card Application Status

Organisation : HDFC Bank Ltd

Facility : Track Credit Card Application Status Online

Country : India

Website : https://www.hdfcbank.com/personal/credit_card/cc_track

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

HDFC Credit Card Application Status

You are required to follow the below guidelines to track the status.

Related / Similar Service : CitiBank Credit Card Application Status

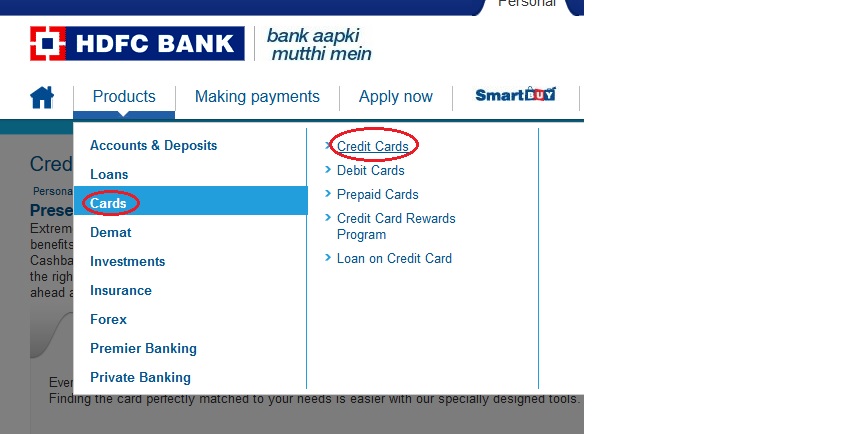

Go to the link of Credit Card by selecting cards section from Products Tab.

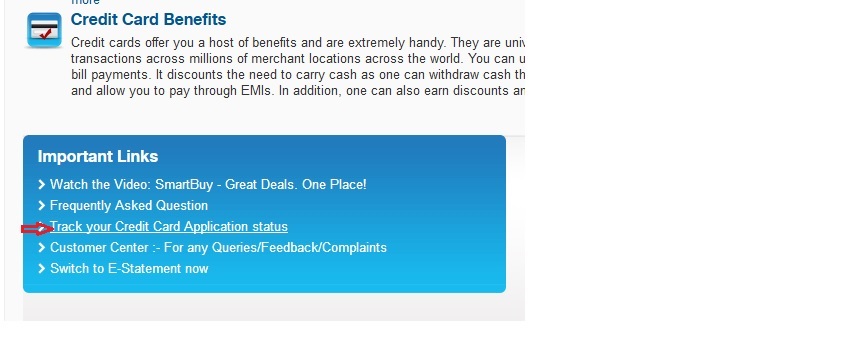

Click Track your Credit Card Application status link.

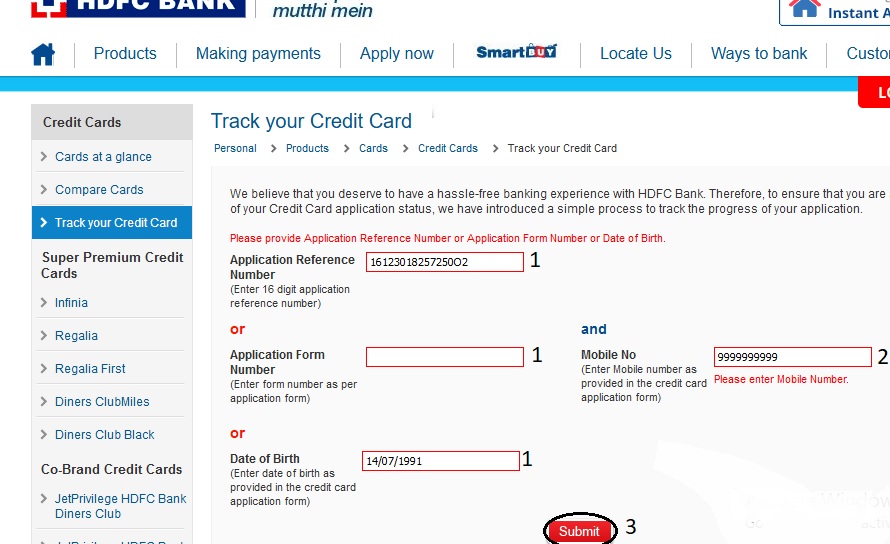

Step 1 : Please provide Application Reference Number or Application Form Number or Date of Birth.

Step 2 : Please enter Mobile Number.

Step 3 : Click Submit Button

Application Reference Number – 16 digits

Form number should be as per application form

Date of birth as provided in the credit card application form

Mobile number as provided in the credit card application form

Loan Application Status

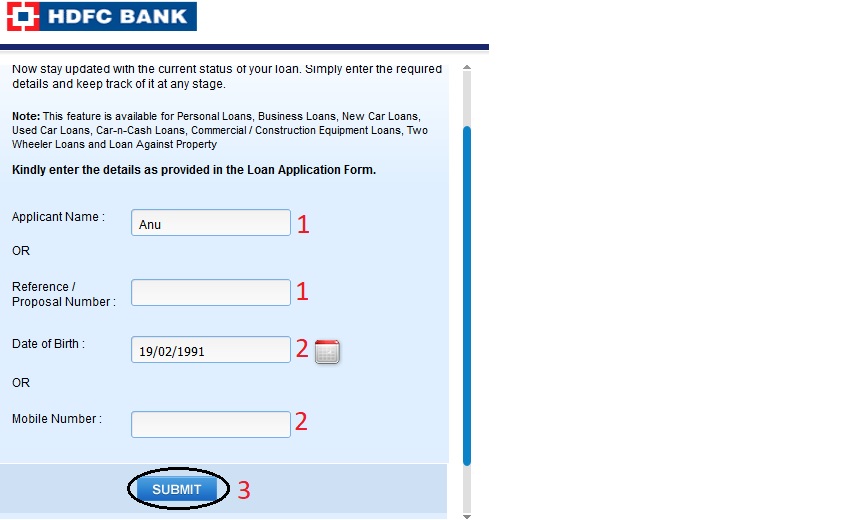

Go to the link of Loan Application status provided below.

Check Loan Status : https://leads.hdfcbank.com/applications/misc/LST/loantracker.aspx

Step 1 :

Enter Applicant Name

OR

Reference / Proposal Number

Step 2 :

Enter Date of Birth

OR

Mobile Number

Step 3 : Click Submit Button

Now stay updated with the current status of your loan. Simply enter the required details and keep track of it at any stage.

Note: This feature is available for Personal Loans, Business Loans, New Car Loans, Used Car Loans, Car-n-Cash Loans, Commercial / Construction Equipment Loans, Two Wheeler Loans and Loan Against Property

Kindly enter the details as provided in the Loan Application Form.

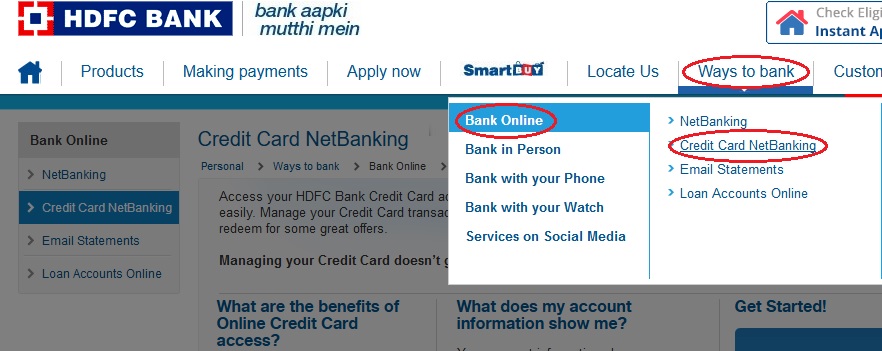

Credit Card NetBanking

Access your HDFC Bank Credit Card account online using NetBanking and view all your account information quickly and easily. Manage your Credit Card transactions, pay your Credit Card bills and track your reward points, which you can redeem for some great offers.

Go to the link of Creditcard Netbanking as shown below

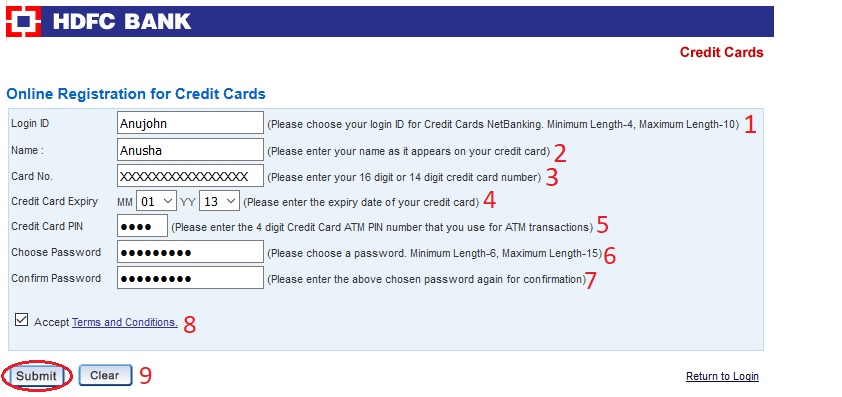

NetBanking Registration :

Part 1 : Register Now to get online access to your credit card.

Step 1 : Please choose your login ID for Credit Cards NetBanking. Minimum Length-4, Maximum Length-10

Step 2 : Please enter your name as it appears on your credit card

Step 3 : Please enter your 16 digit or 14 digit credit card number

Step 4 : Please enter the expiry date of your credit card

Step 5 : Please enter the 4 digit Credit Card ATM PIN number that you use for ATM transactions

Step 6 : Please choose a password. Minimum Length-6, Maximum Length-15

Step 7 : Please enter the above chosen password again for confirmation

Step 8 : Accept Terms and Conditions.

Step 9 : Click Submit Button

Guidelines for Online Credit Card User Password :

1. Please set your password between 6 to 15 characters.

2. The password should be a Alpha-Numeric in nature, i.e. a mix of alphabets, numbers and special characters.

3. Please do not set a password that can be easily compromised (for eg, do not put your name, family name, date of Birth etc) which could be common knowledge to others.

4. Your password is case sensitive ; please ensure you remember the manner in which you set the password.

5. Please change your password periodically.

6. In case the password is not changed then for security reasons every 120 days you would be asked to compulsorily change your password.

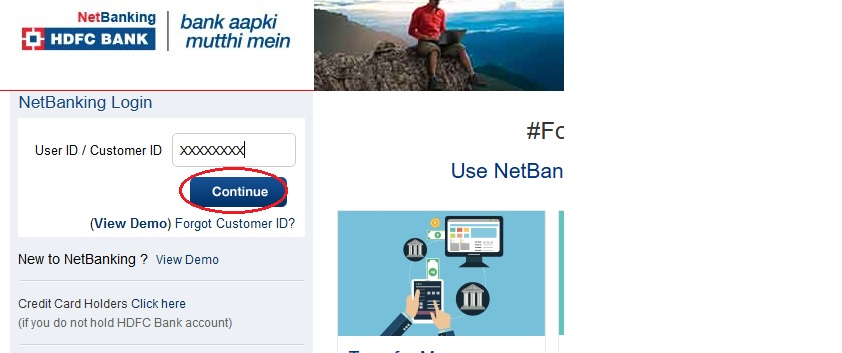

Part 2 :

Login to Netbanking go to your Credit Card tab and click register new card, to register your card.

What are the benefits of Online Credit Card access?

Listed below are the online features you enjoy with your Credit Card

View :

** Account Information

** Unbilled Transactions

** Credit Card Statements (up to last 6 months)

Request for :

** Credit Card Payments

** Autopay Registration

** Autopay De-registration

** Registration of New Card

** De-registration of Card

** Statement on E-mail

** Credit Card ATM Pin

What does my account information show me?

Your account information shows you :

** Your total cash and credit limits

** Your billed and unbilled transactions

** Your payment due date

** The reward points you have earned on your card

This helps you monitor your Credit Card transactions and know when your Credit Card bills are due for payment. You can see your reward points and enjoy the benefits they offer.

Contact Particulars:

The Card member can contact HDFC Bank Credit Cards for making any enquiries or for any grievance redressal through

Please visit hdfcbank.com to know our 24 hours call center number

Through mail – Manager, HDFC Bank Cards

P.O. Box 8654, Thirvanmiyur, Chennai –

600 041

By Email:

customerservices.cards [AT] hdfcbank.com

Loss / theft / misuse of Card :

The Card member must notify the 24 Hour Call Center immediately if the Primary or any Additional credit card is misplaced, lost, stolen, mutilated, not received when due.

Education Loan for Indian Education

Apply for our education loans for Indian education and get loans of up to Rs 10 lakhs.

Our education loans for Indian education offer competitive pricing and give you the option of an insurance cover.

Also enjoy doorstep service and quick disbursal of funds when you apply for education loans for Indian education.

Eligibility Criteria :

** Resident Indians

** Individuals between the ages of 16 and 35

** For Loan amount 4lac <=7.5lac: third party guarantee and parent(s) as joint borrower(s)

** For loan amount > 7.5lac: Tangible collateral security along with Parents to be joint borrower(s)

Features :

High Loan Amounts :

Max loan up to Rs. 10 lakh for studies in India

Wide Range of Collateral Options :

Up to Rs. 4 lakh: No Security. Parents to be joint borrower(s)

Above Rs. 7.5 lakh: Tangible collateral security of suitable value acceptable to bank along with parents to be joint borrower(s).

Approved collateral securities include residential property, HDFC Bank Fixed Deposit, LIC, NSC or KVP Policy

Easy Loan Repayment :

Maximum tenure up to 10 years for loans up to Rs. 7.50 lakhs

Maximum tenure up to 15 years for loans above Rs. 7.50 lakhs

Stay Protected :

When you choose to take an education loan from HDFC Bank, we also provide you with the option to secure your education loan by opting for Insurance Protection in the form of Credit Protect from HDFC Life.

Quick and Easy Disbursals :

Our doorstep service, and quick and easy documentation process ensures that our loans are disbursed as quickly as possible, directly to the education institution, as per their fee structure.

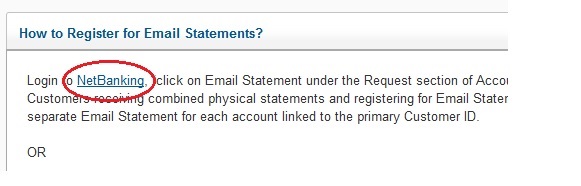

Credit Card Email Statements

As a savings or current account holder you can receive your account statements via email.

Login to NetBanking, “click on Email Statement under the Request section of Accounts tab”.

Click Continue to Internet Banking to proceed for Email Statements.

OR

To register for Email Statements you can Download the E-age form and submit it at your nearest HDFC Bank branch.

OR

You can contact our phone banking to register for e-mail statement.

Features :

** For a Savings account you will get monthly Email Statements.

** For a Current account you can get daily, weekly or monthly Email Statements.

** Email Statements will follow a staggered cycle, based on the date of account opening.

** If you are in the Imperia, Preferred or Classic programme you will receive a combined Email statement for all accounts (across Savings, Current and Fixed Deposits) linked to your Primary Customer ID.

Benefits :

** They are FREE.

** No more paper, no more physical statements.

** Even if you are registered for hold mails, you can get Email Statements.

** You’ll get information on new products and mandatory information online.

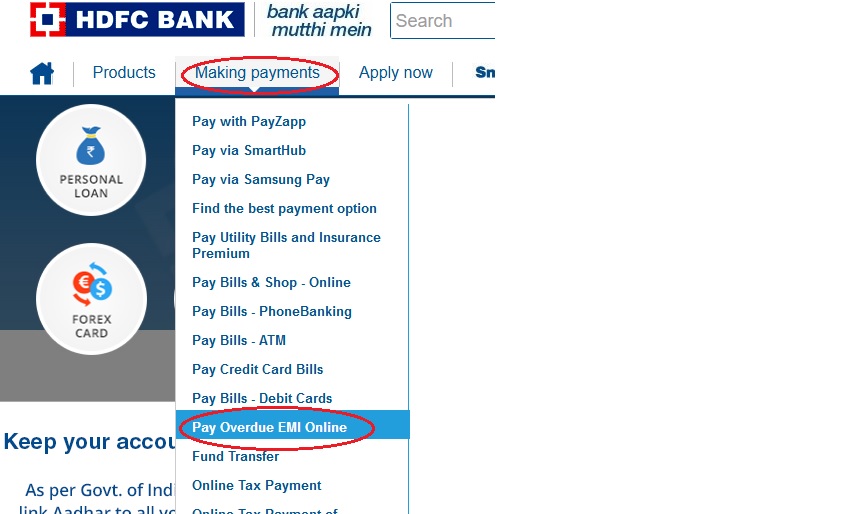

Pay Loan Overdue Online

Go to the link of Pay Overdue EMI online as shown below.

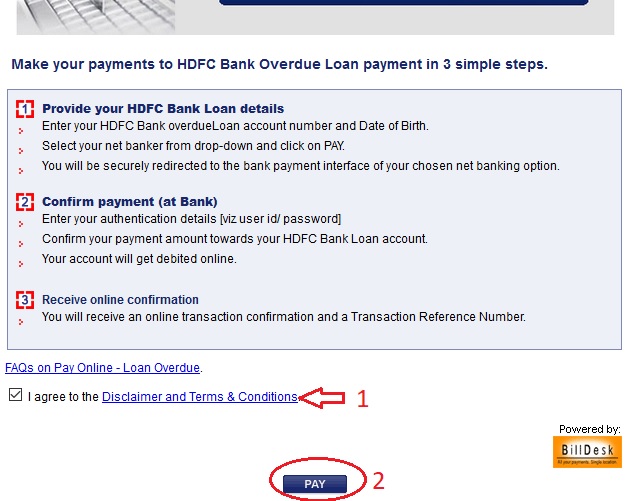

Steps to be Followed :

Provide your HDFC Bank Loan details :

** Enter your HDFC Bank overdueLoan account number and Date of Birth.

** Select your net banker from drop-down and click on PAY.

** You will be securely redirected to the bank payment interface of your chosen net banking option.

Confirm payment (at Bank) :

** Enter your authentication details [viz user id/ password]

** Confirm your payment amount towards your HDFC Bank Loan account.

** Your account will get debited online.

Receive online confirmation :

** You will receive an online transaction confirmation and a Transaction Reference Number.

Step 1 : Accept Disclaimer and Terms & Conditions.

Step 2 : Click Pay Button

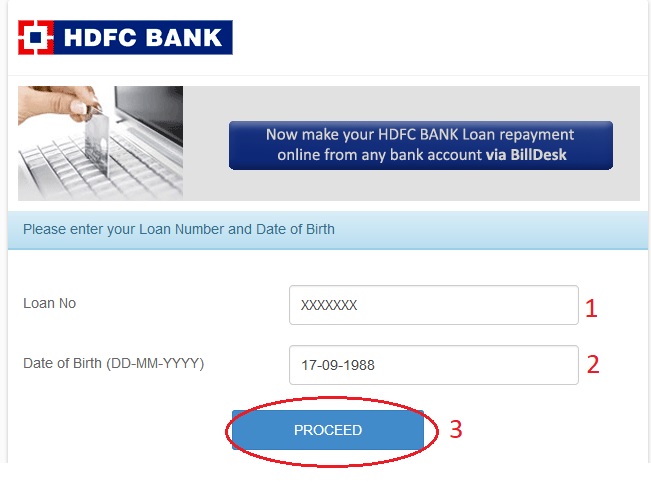

Step 1 : Enter your Loan Number

Step 2 : Enter Date of Birth

Step 3 : Click Proceed Button

* Please do not enter any special character, such as *, &, @, / etc. or space between numbers.

Your transaction is processed through a secure 128 bit https internet connection based on secure socket layer technology.

Answered Questions

I have applied for credit card. My application number is 17050916521XXXX. Please update my application status.

You need mobile number also to check the application status.

My application number is 537XXXX. What is the current status?

You are required to share your mobile number to check the status.

Application REF NO : 160401141XXXX

DOB : 15/06/1980

Please Inform My Application Status

Please provide valid 16 digit Application Reference Number.

I Have Applied For My Personal Loan. Do I need a co-applicant for the loan?

Yes a co applicant is required for all full time courses. Co-applicant could be Parent/ Guardian or Spouse/ Parent-in-law (if married).