Amdavad Municipal Corporation : Property Tax Dues & Paid Details

Organisation : Amdavad Municipal Corporation Gujarat

Facility : Property Tax Dues & Paid Details

Applicable City : Ahmedabad

Home Page : https://ahmedabadcity.gov.in/

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

Amdavad Municipal Property Tax Dues

This post describes about various services of property tax dues, its payment receipt, Hall availability etc.

Related / Similar Service : hsrpgujarat.com HSRP Online Appointment System

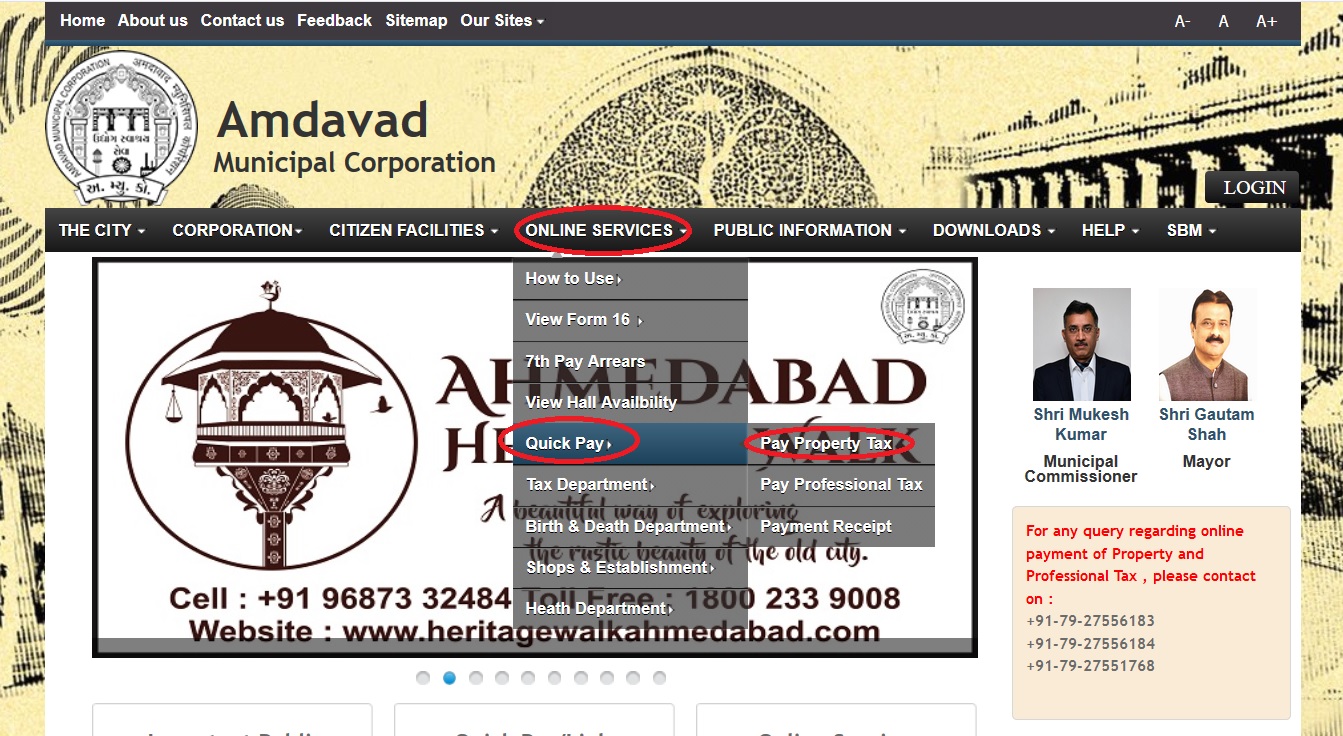

Go to the official website of Amdavad Municipal Corporation. Click the tab Online Services. You will find list of services in the drop down. In that search for Quick Pay, then click Pay Property Tax link.

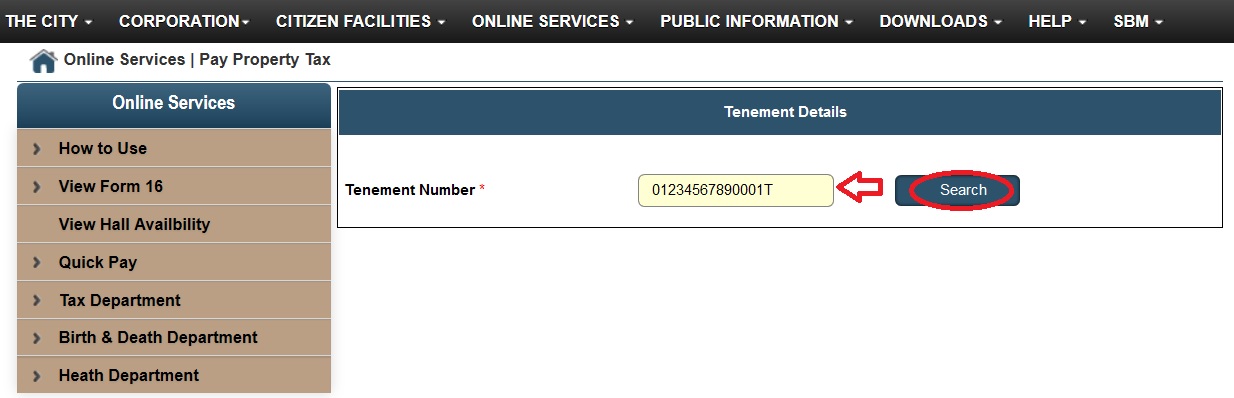

Enter Tenement Number in the text box provided & click search button.

The tenement number is the 15 digits number of the following format – 01234567890001T

Calculation of Property Tax

Property tax is calculated as per the carpet area of the property and 4 factors namely location factor, age factor, type of use factor and occupancy factor as per formula given below

Gen. Tax=Carpet Area (Sq.mtr) X F1 X F2 X F3 XF4

where F1= Location factor

F2=Age factor

F3=Usage factor

F4=Occupancy factor

Property tax payable is calculated after addition of water tax, conservancy tax and education cess payable.

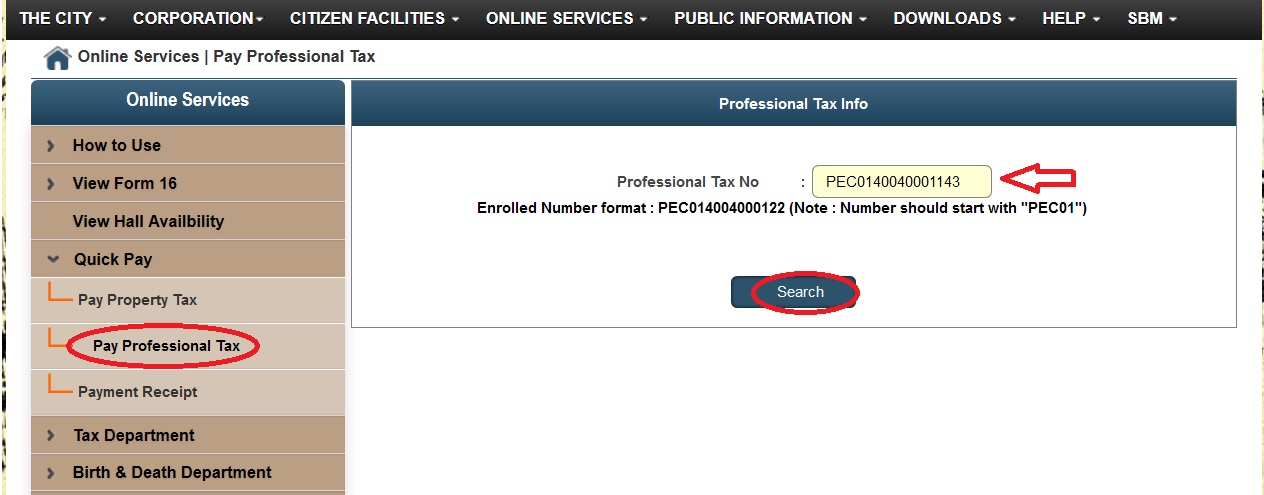

Pay Professional Tax

The link is available in the same section ie under Quick pay tab. Click the respective link of Pay Professional Tax to proceed for payment.

Enter Your Professional Tax Number in the Text Box available.

Enrolled Number format : PEC014004000122 (Note : Number should start with “PEC01”)

Payment Receipt & Search Tenement Details

You can download the receipt of your payment of both property tax & professional tax by using this facility.

Step 1 : Select Service Name as Property Tax or Professional Tax

Step 2 : Enter your Tenement No for Property Tax or Professional Tax No for Professional Tax

(Eg : Tenement No – 01234567890001T, Professional Tax No – PEC014004000122)

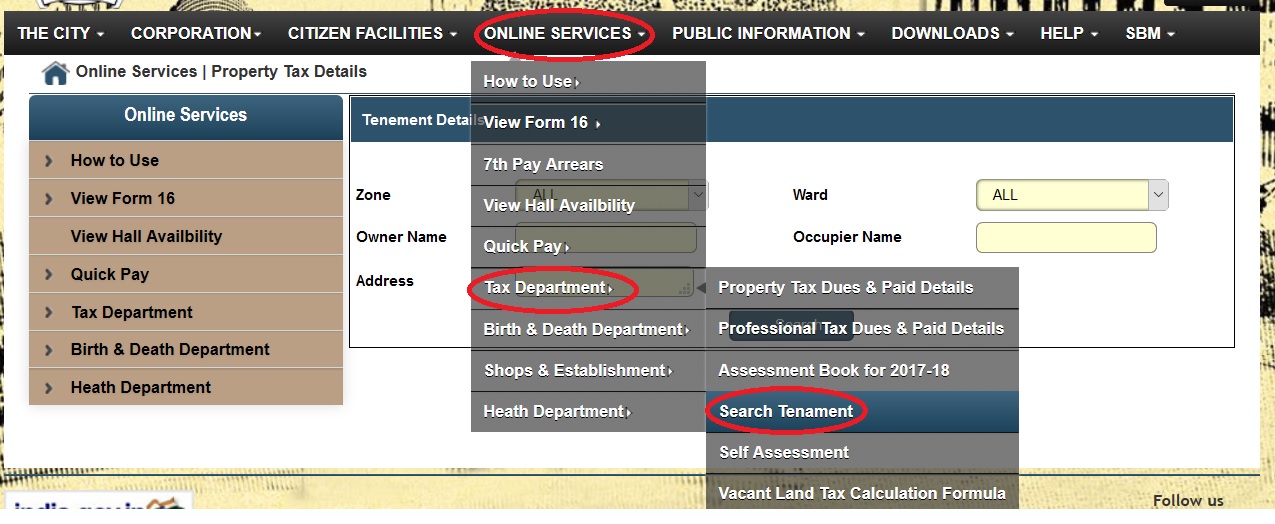

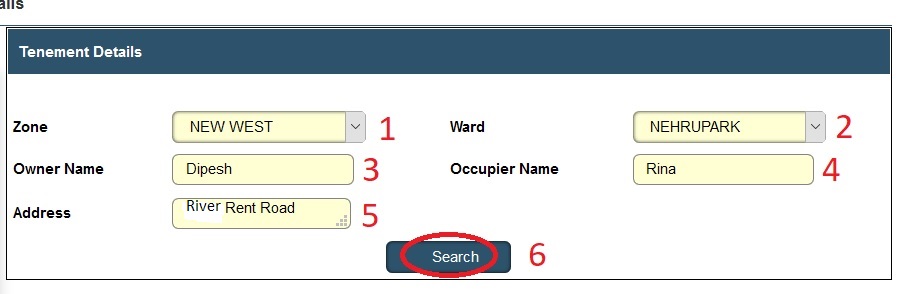

Search Tenement Details :

Click Online Services tab. Click the link Tax Department. Then click on the service Search Tenement Details available in the list.

Step 1 : Select Your Zone (Eg : Central)

Step 2 : Select Your Ward (Eg : Raipur)

Step 3 : Enter Owner Name (Eg : Dipesh)

Step 4 : Enter Occupier Name (Eg : Rina)

Step 5 : Enter Your Search Address (Eg : River Rent Road)

Step 6 : Click Search Button

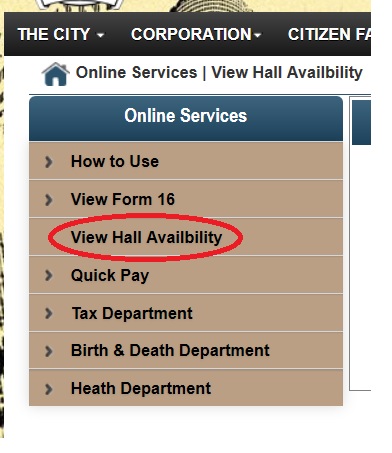

View Hall Availability

You can check the Availability of Hall by following the below steps.

Click the link View Hall Availability under Online Services tab.

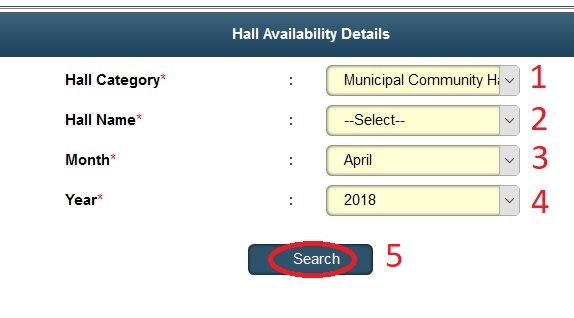

Step 1 : Select Hall Category (Eg : Open Air Theater)

Step 2 : Select Hall Name (Eg : Emphy Theater)

Step 3 : Select the Month You are looking for (Eg : April)

Step 4 : Select Year You are searching for(Eg : 2018)

Step 5 : Click Search Button

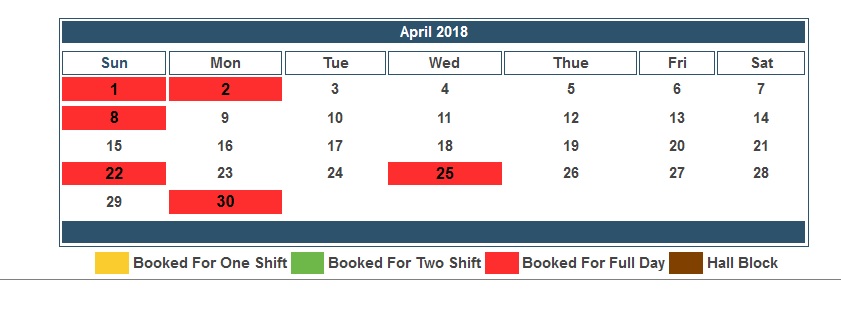

You will get the result in the following format.

How to use Online Service

AMC is committed towards providing the best eGovernance services to its citizens. By registering on this website you can link all of your Property Tax and Professional Tax numbers in your profile and thus can make payments to all of them with just one log in id. This will enable you pay taxes on time without having to manage all the documents for it.

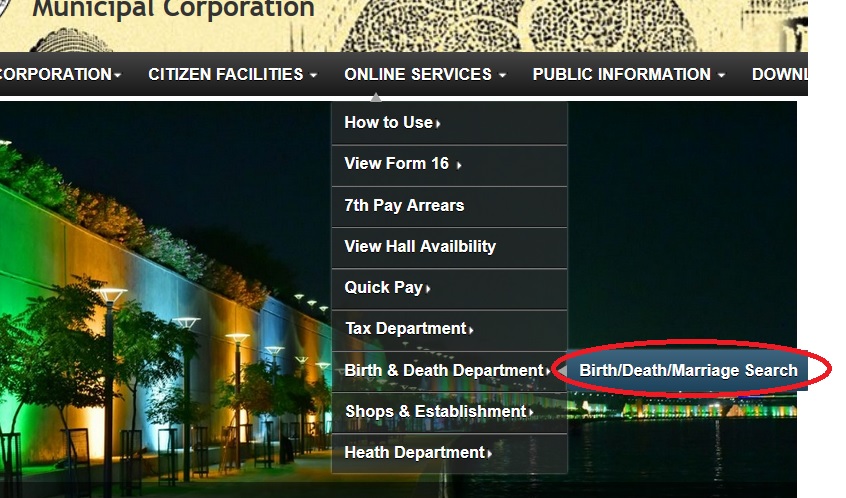

Please register yourself with this website. Follow the below guidelines for citizen registration. Citizen Registration link is available in the official website as shown below.

All fields marked with * are mandatory.

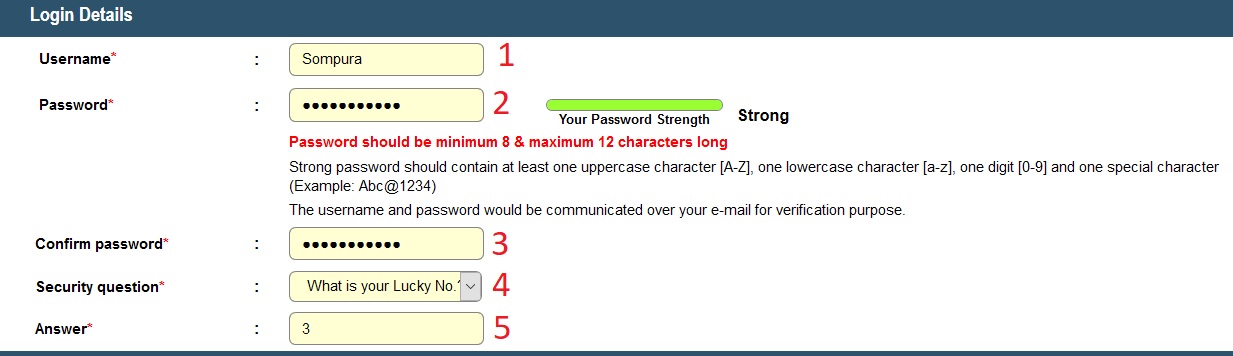

Login Details :

Step 1 : Enter Your Username. It will check the availability of your name(Eg : Dipesh)

Step 2 : Create Your Password

Password should be minimum 8 & maximum 12 characters long

Strong password should contain at least one uppercase character [A-Z], one lowercase character [a-z], one digit [0-9] and one special character (Example: Abc@1234)

The username and password would be communicated over your e-mail for verification purpose

Step 3 : Confirm password by entering the same like above text box

Step 4 : Select Your Security question (Eg : What is Your Pet Name?)

Step 5 : Enter Your Answer Here (Eg : Cat)

Personal Details :

Step 6 : Select Your Salutation (Eg : Mrs)

Step 7 : Select Your Gender (Eg : Female)

Step 8 : Enter Your First Name (Eg : Rina)

Step 9 : Enter Your Last Name (Eg : Dipesh)

Step 10 : Enter Your Date of Birth (dd/mm/yyyy) (Eg : 17/09/1978)

Age will be displayed automatically

Step 11 : Enter Your Mobile Number (Eg : 9999999999)

Step 12 : Enter Your Email Id (Eg : abcde @ gmail.com)

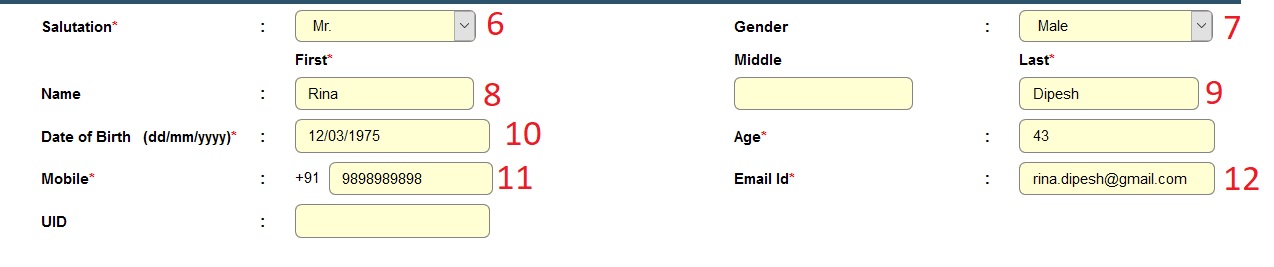

Present Address :

Step 13 : Enter Your House No., Building/Block (Eg : 12 B)

Step 14 : Enter Your Society, Road, Area Name (Eg : River Rent Road)

Country, State, City will be automatically loaded in drop down

Step 15 : Enter Your Correct Pincode (Eg : 380002)

Step 16 : Select the check box if Permanent Address is same as the Present Address

Step 17 : Type the Code Shown

Step 18 : Enable SMS & Email alerts if Required

Step 19 : Accpe the Terms & Conditions

Step 20 : Click Submit Button

After successful registration, you need to login using OTP received during the online registration process.

After Logging in, you can link all of your Property Tax and Professional Tax numbers in your profile and thus can make payments to all of them with just one log in id.

For any query regarding availing of online services , please contact on

1) +91-79-27556183

2) +91-79-27556184

For any other query, please contact on 155303

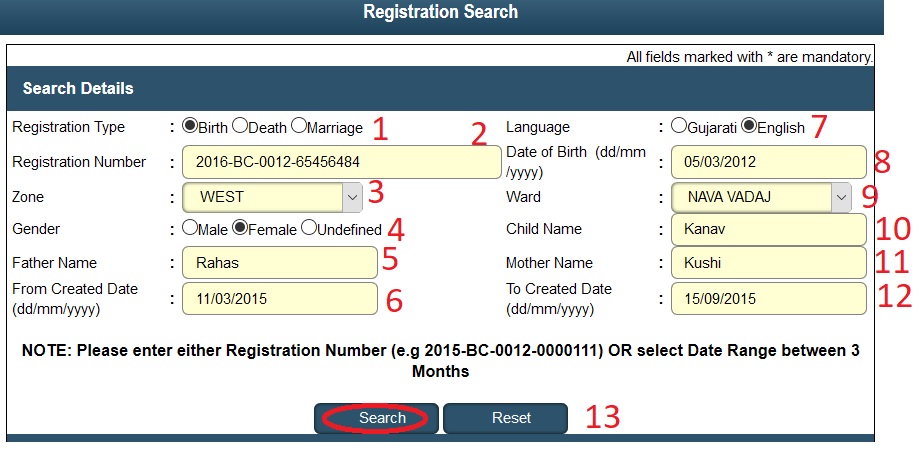

Birth / Death/ Marraige Search

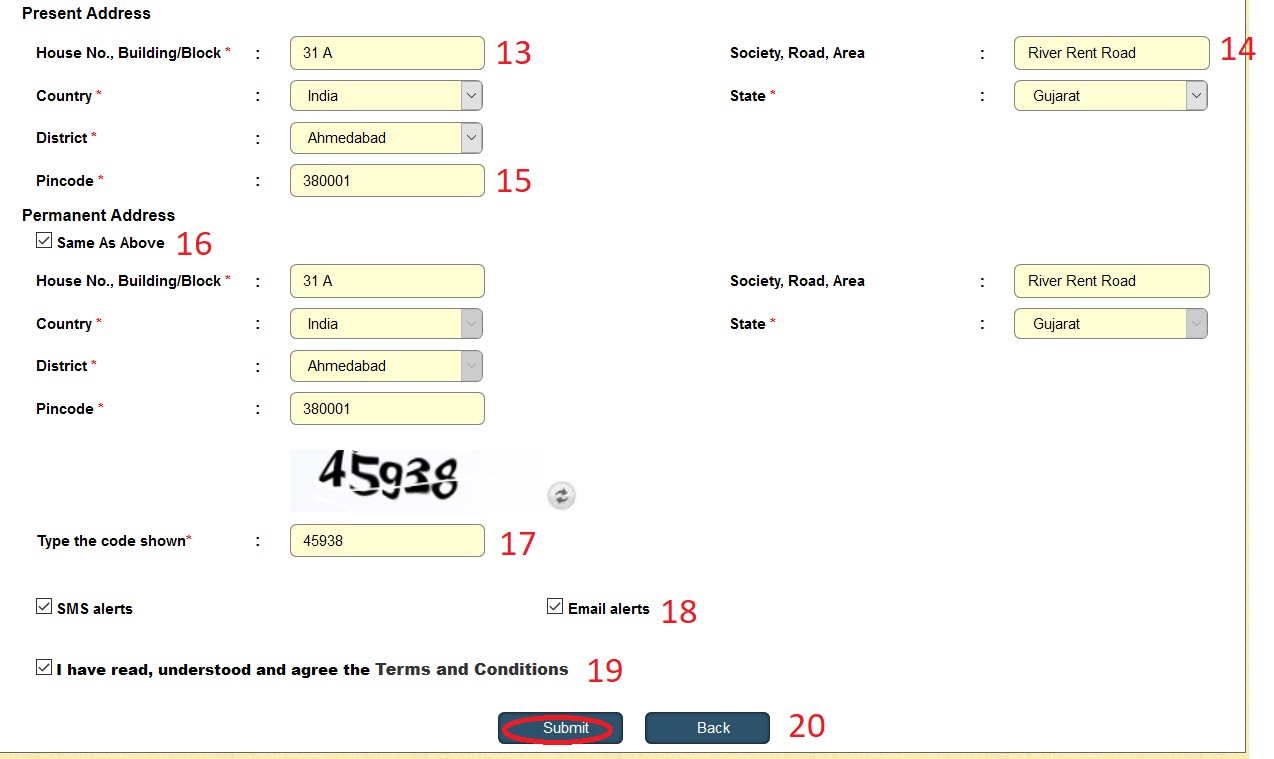

Go to the link of Birth / Death/ Marriage Search available under Online Services as shown below.

Step 1 : Select Registration Type as Birth or Death or Marriage

Step 2 : Select Your Language as Gujarati or English

Step 3 : Enter Your Registration Number (Eg : 2015-BC-0123-9685741)

NOTE: Please enter either Registration Number (e.g 2015-BC-0012-0000111) OR select Date Range between 3 Months

Step 4 : Select Your Date of Birth (dd/mm/yyyy) from the Calendar

Step 5 : Select Your Zone (Eg : West)

Step 6 : Select Your Ward (Eg : Vasna)

Step 7 : Select Your Gender (Eg : Male)

Step 8 : Enter Your Child Name (Eg : Kanav)

Step 9 : Enter Applicant’s Father Name (Eg : Dipesh)

Step 10 : Enter Applicant’s Mother Name (Eg : Kushi)

Step 11 : Enter Your From Created Date in the format of dd/mm/yyyy

Step 12 : Enter Your To Created Date in the format of dd/mm/yyyy

Step 13 : Click Search Button

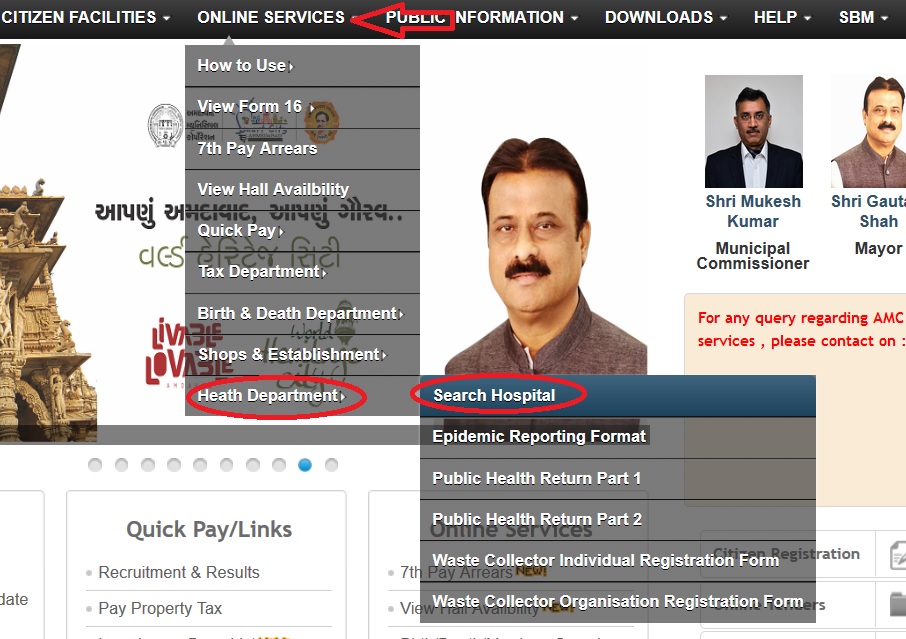

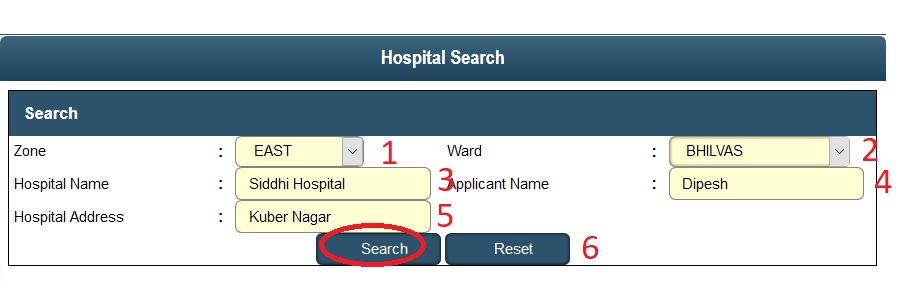

Hospital Search

Go to the link of Hospital Search facility under Health Department.

Step 1 : Select Your Zone (Eg : East)

Step 2 : Select Your Ward (Eg : Bhilvas)

Step 3 : Enter Hospital Name for Search (Eg : Rudhraksh Hospital)

Step 4 : Enter Applicant Name (Eg : Dipesh)

Step 5 : Enter Hospital Address (Eg : Patiya)

Step 6 : Click Search Button

FAQs

Property Tax

What is the procedure for having one bill instead of 2 separate bills?

For this purpose one should fill form of kami of Duplicate bill. Further details are shown in the form.

What is the procedure if tenant has vacated the property?

In this case form of Tax Occupier change (TOC) should be filled. Documents for this purpose such as possession receipt of tenant is to be attached.

In what name should I write my cheque of property tax payment? Is outdated cheque accepted?

Cheque should be in name of ” Municipal Commissioner, Ahmedabad” . Other details such as the ward, Tenament No., contact No. should be written on the backside of the cheque.

Out of town cheque is not accepted, However if clearing is done in Ahmedabad it is accepted.

When do I have to pay Advance tax?

Advance tax scheme is generally announced in the month of April every financial year. Advertisement is done in newspapers regarding this.

Tax paid online but amount is still showing pending?

In such cases send details by mail to info @ egovamc.com.

Professional Tax

Is it compulsory for the professionals enumerated in Schedule 1 to get enrolled?

Yes, A person already enrolled need not apply for enrolment again.

In which office one should get enrolled him self?

At any City Civic Center or at the zonal profession tax office.

What is the method of payment?

Payment can be made at any City Civic Center by cash or a cheque/Demand Draft in Favor of “Municipal Commissioner- Ahmedabad” payable at Ahmedabad or ONLINE Payment.

Where could these forms be obtained from?

From the relevant profession tax office or the web site egovamc.com or , at any City Civic Center .

Do you have to enroll for each place of branch separately?

Yes, Each branch is deemed as separate assessee under the Act.

What if the person falls under more than one category of the schedule.

The details of all the categories has to be filled up in the Form-3 and the HIGHEST RATE applicable shall be paid.

What is the last date for the payment of Tax?

Normally you can pay between 1st April to 30th September every year.