services.gst.gov.in Track Provisional ID Status/Grievance Registration /Locate GST Practitioner : Goods & Services Tax

Organisation : Goods and Services Tax

Facility : Track Provisional ID Status/Grievance Registration & Check Status/Locate GST Practitioner

Applicable For : All India

Website : https://services.gst.gov.in/services/login

| Want to comment on this post? Go to bottom of this page. |

|---|

Contents

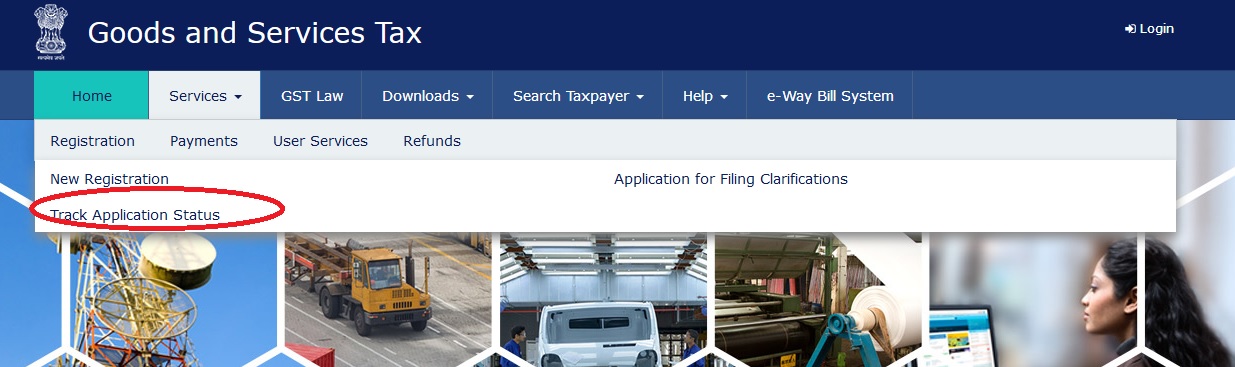

How To Track GST Provisional ID Status?

GST Services to get Track Provisional ID Status/Grievance Registration & Check Status/Locate GST Practitioner, search Office Address .

Related / Similar Service : Trichy Corporation Property Tax Online Payment

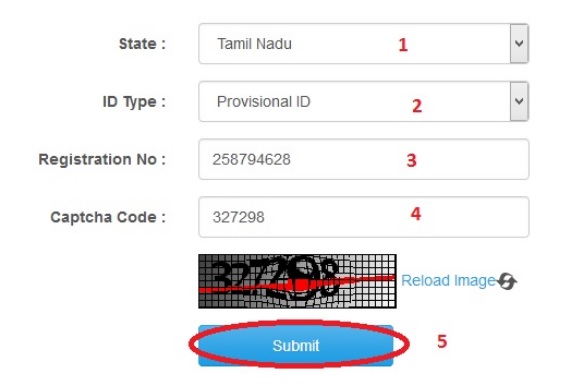

Go to the above link then enter the following details to check the Provisional Id Status.

Steps :

1. Select Your State Name [Tamil Nadu]

2. Select your ID Type [provisional ID]

3. Enter Your Registration Number

4. Enter the captcha code shown below

5. Click on submit button,your status will be displayed on the screen.

Locate GSTP

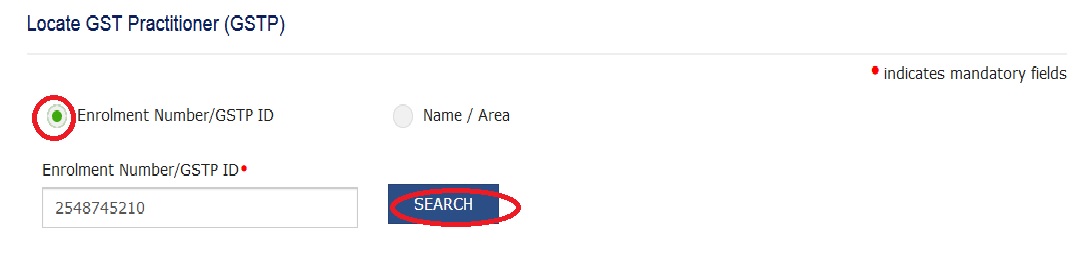

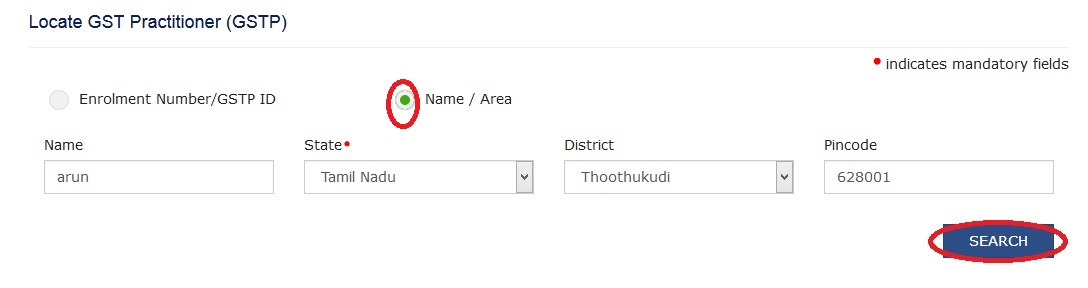

Please enter the following details to locate your GST Practioner, you can locate GSTP by either Enrolment Number/GSTP ID Or Name / Area

Steps :

Enrolment Number/GSTP ID :

Step 1 : Enter Enrolment Number/GSTP ID

Step 2 : Click on the Search button

Name / Area :

Step 1 : Enter Name

Step 2 : Select State

Step 3 : Select District

Step 4 : Enter Pincode

Step 5 : Click on the Search button

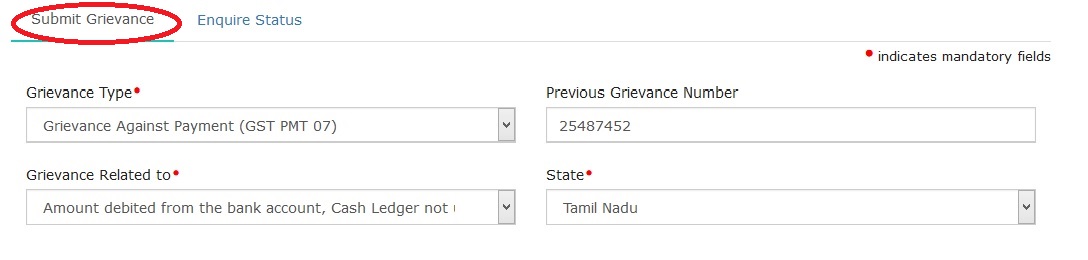

How To Do Grievance Registration?

Please enter the below details to register your complaints/grievance,

Steps :

Step 1 : Enter Previous Grievance Number

Step 2 : Select Grievance Type

Step 3 : Select Grievance Related to

Step 4 : Select State

Details of Taxpayer(Person) who is reporting the grievance :

1. Select Registered Taxpayer/Unregistered Person

2. Enter GSTIN/UIN/Temporary ID

3. Enter Name and Address of Business

4. Enter Name of Complainant

5. Enter Email Address

6. Enter Mobile Number +91

7. Enter Permanent Account Number (PAN)

8. Enter Description of Grievance(4000 characters)

9. Upload Supporting Document – File with PDF or JPEG format is only allowed. Maximum file size for upload is 500 KB.

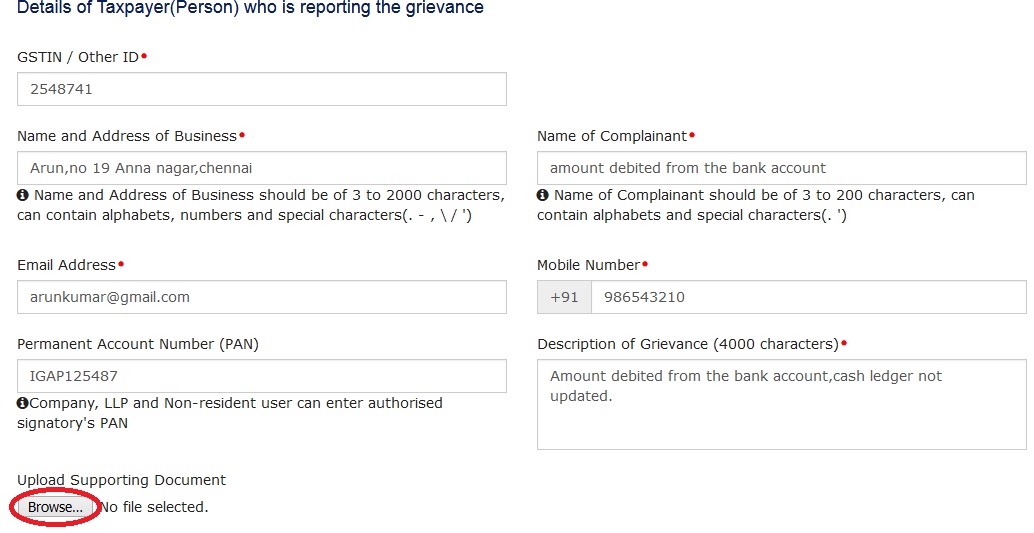

Discrepancy In Payments :

1. Enter CPIN – Enter ‘Grievance Related to’, ‘State’, ‘GSTIN/UIN/Temporary ID’ and ‘PAN’ first

2. Type the characters you see in the image below

3. Click on submit with

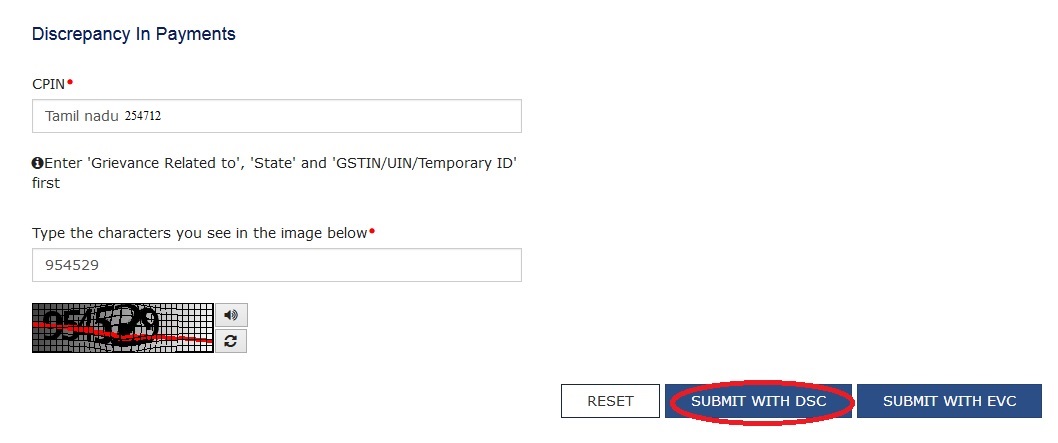

Grievance Enquire Status

Please enter the below details to check your Complaint status,

1. Enter Grievance Number

2. Type the characters you see in the image below

3. Click on the Search button

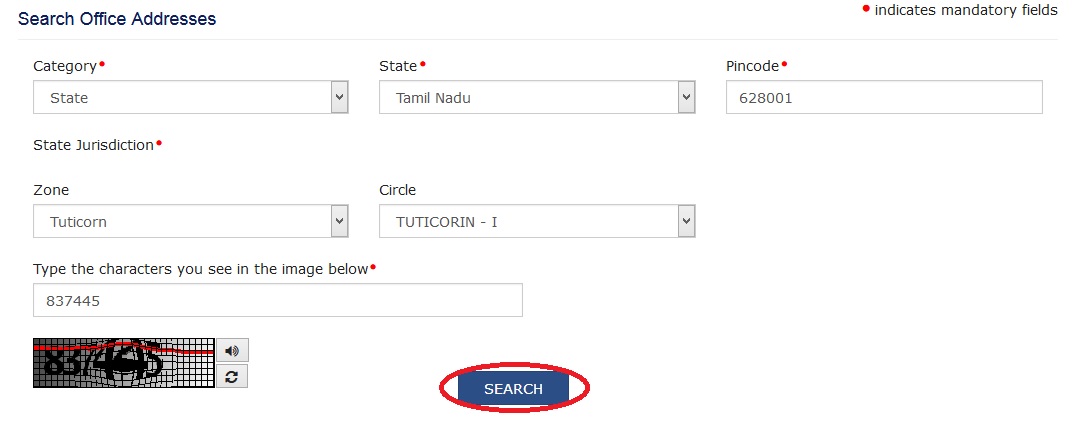

Search Office Addresses

1. Select Category

2. Select State

3. Enter Pincode

4. Select State Jurisdiction

5. Select zone

6. Select circle

7. Type the characters you see in the image below

8. Click on Search button.

FAQs On GST

Frequently Asked Question (FAQs) On GST

Registration

1. I have multiple businesses in one state registered using the same PAN. Do I need to enrol each business separately with GST?

As one PAN allows one GST Registration in a State, you may register one business entity first. For the remaining business within the State please get in touch with your Jurisdictional Authority.

2. What is ISD Registration?

ISD stands for Input Service Distributor. An Input Service Distributor refers to a person who distributes credit, in respect of the tax invoices of the services received at the Head Office, to its branches where the services have been supplied actually.

Tax invoice refers to the invoice issued under Section 23 of the Model Goods and Services Act. If you are an existing ISD Taxpayer, you need to apply afresh in the GST Common Portal for the State in which you desire to seek registration. For that you need to inform your Central Jurisdictional Authority.

3. Do the Taxpayers need to enrol for all states in case of additional place of business in multiple States or only in one state where principal place of business is located?

Provisional ID is issued on the basis “State + PAN” combination. If a taxpayer is registered under earlier law in different states, the taxpayer has been issued provisional id for each state (where it is registered).

In case of additional places of business located in multiple states and they have not been registered in earlier law, the taxpayer need to apply for registration afresh for those particular States under GST after the appointed date.

4. What should be entered in the commissionerate code field while completing the enrolment process of branch office? Can the Taxpayers use commissionerate code of head office?

For filling the Centre Jurisdiction field, Taxpayer has been provided with a reference/help link of the ACES website to guide him with the mapping of Commissionerate codes.

Commissionerate code is based on the address of the Principal Place of Business in that State. If the Head office is situated in any other state, then the Centre Jurisdiction will be based on the Address of the Place of Business for which registration is sought.

GSTP

1. Who is a GST Practitioner?

GST Practitioner is a tax professional who can prepare returns and perform other activities on the basis of the information furnished to him by a taxable person. However, the legal responsibility of such filings remains with the Taxpayer.

For this purpose, GST Practitioners (GSTP) are required to be enrolled with Centre or State Authority. CA, CS, CMA, Advocates, Retired Government Officials, and Graduates are eligible to apply for registration.

In addition, GSTPs can be appointed Authorized Representatives who can act on the behalf of the taxpayers and represent them before tax authorities.

2. Can I file Returns for my client if I am not registered?

It is recommended that you register as a GST Practitioner at the GST Portal.

3. Are there any preconditions before I can enroll on the GST Portal as a GST Practitioner?

A GST Practitioner must fulfill the following conditions he/she can enroll on the GST Portal :

1. Applicant must have a valid PAN Card

2. Applicant must have a valid mobile number

3. Applicant must have a valid e-mail ID

4. Professional address

5. Applicant must have the prescribed documents and information on all mandatory fields as required for Enrolment

6. Applicant must fulfill the eligibility criteria of GST Practitioner.

Grievance

1. For which issues can I raise a grievance?

Grievance can be raised in case of following issues :

** Amount debited from the bank account, Cash Ledger not updated

** NEFT/RTGS related issues

Please do not raise a grievance under the following conditions :

** Before 24 hours of debit of amount from the bank account

** If payment status is PAID and amount is updated in Cash Ledger.

** In case of E-payment, payment not initiated from the GST Portal.

** If Memorandum of Error (MoE) is raised against the CPIN.

** Payment status is Failed and amount is not debited from bank account

** In case of OTC Payment, status is AWAITING BANK CLEARANCE and cheque/ Demand Draft is not realized.

2. Who can report grievances? Do I need to be a registered user of GST Portal for filing grievances?

Any registered taxpayer and any user who has been assigned Temporary ID can raise grievance for Payment related issues.

3. Who addresses the submitted grievances?

All grievances related to Payments are handled by the GST Portal. Based on the CPIN and Bank name entered by Taxpayer in the Grievance Form, an on demand call will be sent to the concerned bank.

Based on the response from the bank, the Electronic Cash Ledger will be updated with appropriate comments and the grievance will be closed.

If no response is received from the concerned bank or incorrect response is received from the bank, the Grievance ticket will be closed with appropriate remarks explaining the error occurred;

E.g “No details received from your bank for CPIN. Please contact the bank to resolve this. You can also contact the ombudsmen of the concerned bank if the bank is not responding.”.

The remarks will be sent to you on the registered email address and SMS of the authorized signatory. In case of taxpayers who have been filed grievance in pre-login mode, the remarks will be sent on the e-mail message and mobile phone number mentioned in the grievance form.